Market Sizing for B2B SaaS Founders

A Comprehensive Guide for founders to estimate market size - TAM, SAM, SOM

Hi PMs

Today’s topic is market sizing.

A couple of weeks back, I made a presentation to some startup founders at Berkeley Skydeck where I am an advisor for the Enterprise track.

Market sizing is something we rarely do as regular PM work. Startups founders however have to estimate their market size, especially if they are raising funds. In this article, I’ll share what I presented to these founders.

Why We Do Market Sizing

Market sizing is a crucial step for B2B SaaS founders, providing a foundation for strategic decision-making and resource allocation.

These are not just mere slides in your investor pitch, they are meant to pressure test your assumptions.

Here’s why it’s essential:

Test Assumptions: Market sizing helps validate or challenge the assumptions about the market, enabling founders to build a realistic business model.

Find Uncharted Areas: It can reveal niches or underserved segments that present unique opportunities for innovation and growth.

Assess Demand: Understanding the market size aids in gauging the demand for your product, ensuring there is a viable customer base.

See Overall Potential to Grow: By quantifying the market, founders can project potential revenue and growth trajectories, which are critical for attracting investors and planning long-term strategies.

Definitions of TAM, SAM, SOM

To effectively size a market, it's important to understand three key metrics:

Total Addressable Market (TAM): The total revenue opportunity available if your product achieves 100% market share in a broad market. It represents the maximum demand for your product or service.

Serviceable Available Market (SAM): The segment of TAM that is within your reach given your business model, geographical constraints, and other limiting factors.

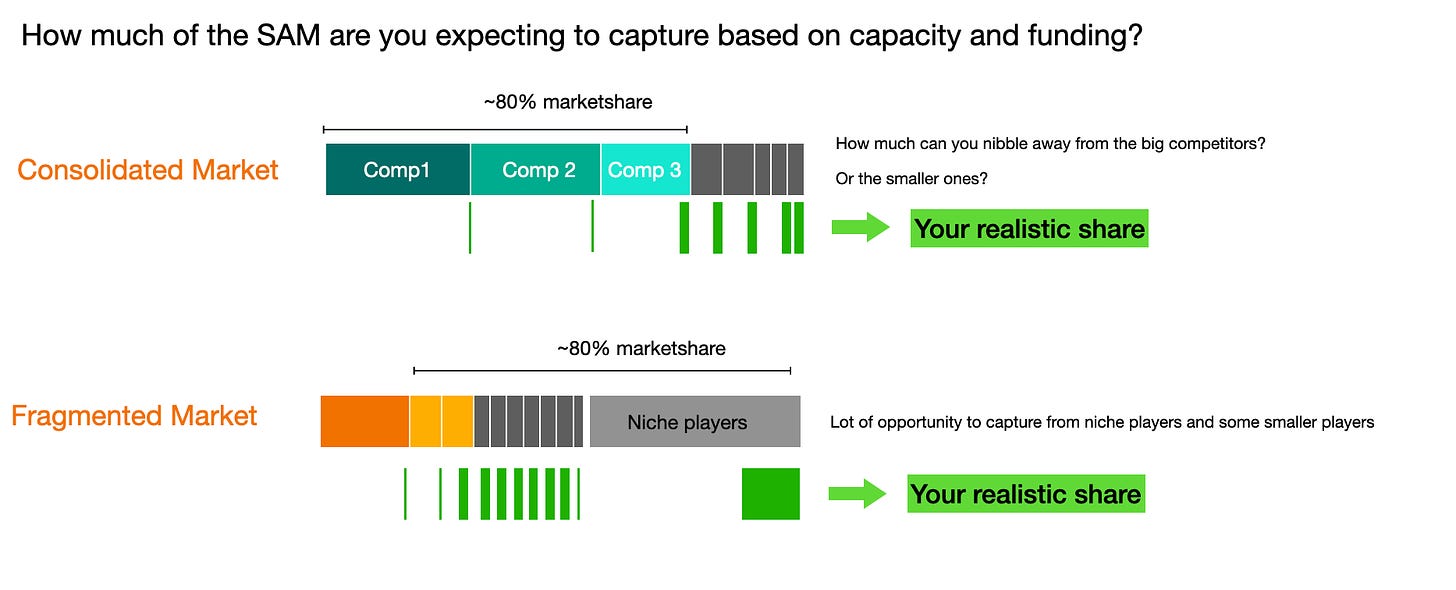

Serviceable Obtainable Market (SOM): The portion of SAM that you can realistically capture, considering factors like competition, market saturation, and your current capabilities.

Don’t just make an assumption of a small number number like just 1%. Go through your market alternatives, and realistically assess what you can capture.

If you are in a competitive market, which competitors can you realistically replace. Which ones are entrenched and hard to dislodge. If you are in a consolidated market, what can you capture from incumbents, if at all.

What Investors Are Looking For

Investors scrutinize market sizing closely to gauge the potential return on investment. Here’s what they typically look for:

Clear Understanding of TAM, SAM, and SOM: Investors want to see a well-defined and thoroughly researched TAM, SAM, and SOM to understand the full market potential and your realistic share of it.

Realistic and Data-Driven Assumptions: Assumptions should be backed by credible data sources and sound reasoning. Overly optimistic or vague assumptions can raise red flags.

Market Growth Potential: Investors look for markets with significant growth potential. They prefer industries that are expanding and have room for innovation.

Competitive Landscape Analysis: A thorough analysis of the competition and how your product differentiates itself is crucial. Investors want to see a unique value proposition that stands out in the market.

Scalability: The business model should be scalable, with the potential to grow significantly within the market. Investors seek signs that the business can expand its customer base and increase revenue without proportional increases in costs.

Revenue Projections: Accurate and achievable revenue projections based on market sizing provide investors with confidence in your financial planning and business acumen.

Strategic Fit: Investors often look for a strategic fit with their portfolio and expertise. Demonstrating how your market and business align with their interests can enhance your appeal.

Steps to market sizing

Identify the target market and customer segments - critical and >50% of the effort

Clarify the use case, problem solved, value proposition (do not assume there is a need for everyone)

Segment your part of the market

Calculate volume (Top down and Bottoms up methods)

Calculate potential revenue

Top-Down Method of Sizing

The top-down approach begins with a macro view and narrows down to specifics:

Start with Industry Reports: Use industry reports and analyst data to get an overall market size.

Segment the Market: Break down the total market into segments relevant to your product.

Apply Market Share Assumptions: Estimate the share of the market your business can capture based on competitive analysis and market trends.

Bottoms-Up Method of Sizing

The bottoms-up approach builds the market size from detailed micro-level data:

Identify Potential Customers: Count the number of potential customers within your target segments.

Estimate Average Revenue Per User (ARPU): Calculate the expected revenue per customer based on pricing models and customer purchasing behavior.

Scale Up: Multiply the number of potential customers by the ARPU to estimate the total market size.

Here is a good example of how Wework did it.

Sources of Data

There are many generic and industry specific source of data you can draw your assumptions from.

There are many generic and industry-specific sources of data you can draw your assumptions from, such as:

There are many industry specific sources as well.

Caveats in Market Sizing

Here is what I call lazy market sizing.

We have a huuuuuge market

Our very conservative estimate is

If only 1% of people in China buy our product -> 1% of 1.4 B = 14 Mn

We only charge $ 10 per month -> 14 Mn * $10 * 12

Our TAM is $ 1.7 Bn

Mark Cuban says if you do something like, he is out.

Market sizing, while essential, comes with its own set of challenges and limitations. Here are a few caveats to be aware of:

Caveats in Market Sizing

Market sizing, while essential, comes with its own set of challenges and limitations. Here are a few caveats to be aware of:

Overestimating Market Size: Assuming a large market without thorough research can lead to overconfidence and misallocation of resources.

Underestimating Competition: Ignoring existing competitors or potential new entrants can leave a startup unprepared for market dynamics.

Misjudging Customer Needs: Failing to accurately understand what customers want or need can result in a product that doesn’t meet market demand.

Neglecting Market Trends: Overlooking trends and shifts in the market can cause a business to miss out on emerging opportunities or be blindsided by changes.

Unclear Target Market and Segmentation: Without clear segmentation, such as targeting EV batteries without specifying whether it's for commercial, industrial, or consumer use, market estimates can be inaccurate.

No Basis for Any Source: Estimates must be grounded in data. Claiming "we estimate 75% of TAM to benefit from our product" without evidence undermines credibility.

Double Counting: Avoid counting the same consumers multiple times, such as when an app's potential market includes both tablet and phone users, some of whom own both devices.

Assuming Homogenous Demand: Different segments have different needs. For instance, men are more likely to experience hearing loss than women, impacting the demand for hearing-related products.

Global Variance in Spend and Adoption: Market behaviors vary by region. The US, for example, spends significantly more on entertainment than Europe and Asia, affecting market size estimates.

Incomplete or Imperfect Data: When country-specific data isn't available, using comparables from related industries can introduce inaccuracies.

Total Market Where You Are One of the Components: Including the entire market size when you only offer one component (e.g., windows in the real estate market) can grossly overestimate potential.

Extrapolation from Small Samples: Using data from small or unrepresentative samples, like assuming market behavior based on a neighborhood where 30% of people have cats, can lead to faulty conclusions.

Small Share of Large Numbers: Assuming capturing just a tiny percentage of a huge market, like 1% of the Chinese market, can be unrealistic and misleading.

Economic and Regulatory Factors: External factors like recessions, trade wars, sanctions, and data privacy laws can drastically impact market size and must be accounted for.

Not Able to Explain Assumptions: Being unable to clearly explain and justify your assumptions is the most critical flaw. Transparent and logical assumptions are essential for credibility.

Conclusion

Market sizing is a critical exercise for B2B SaaS founders, offering a clear picture of the market landscape and informing strategic decisions. By understanding and applying both top-down and bottoms-up methods, and being mindful of the common pitfalls and caveats, founders can set realistic goals and identify the best pathways to growth. Investors, in turn, will look for solid market sizing backed by robust data and sound assumptions, clear competitive advantages, and significant growth potential.

Market size should be instinctually obvious. If you can :

Explained the market clearly

The pain point is obvious

the number of customers who will benefit is believable

Are you a startup or a product team and need help with market sizing approaches?

Book a free 30 min slot.

Or just subscribe to this weekly newsletter where I share my B2B experiences.