Hey Startup Founders and PMs,

Let’s talk about the B2B buyer’s journey. Most sales and marketing efforts focus on prospects who are already in the market—researching, reviewing, and evaluating solutions.

But what happens before that?

Before a buyer even considers your product, they go through key decision points that determine whether they will take action at all. If you don’t understand these, your sales and marketing efforts might be wasted.

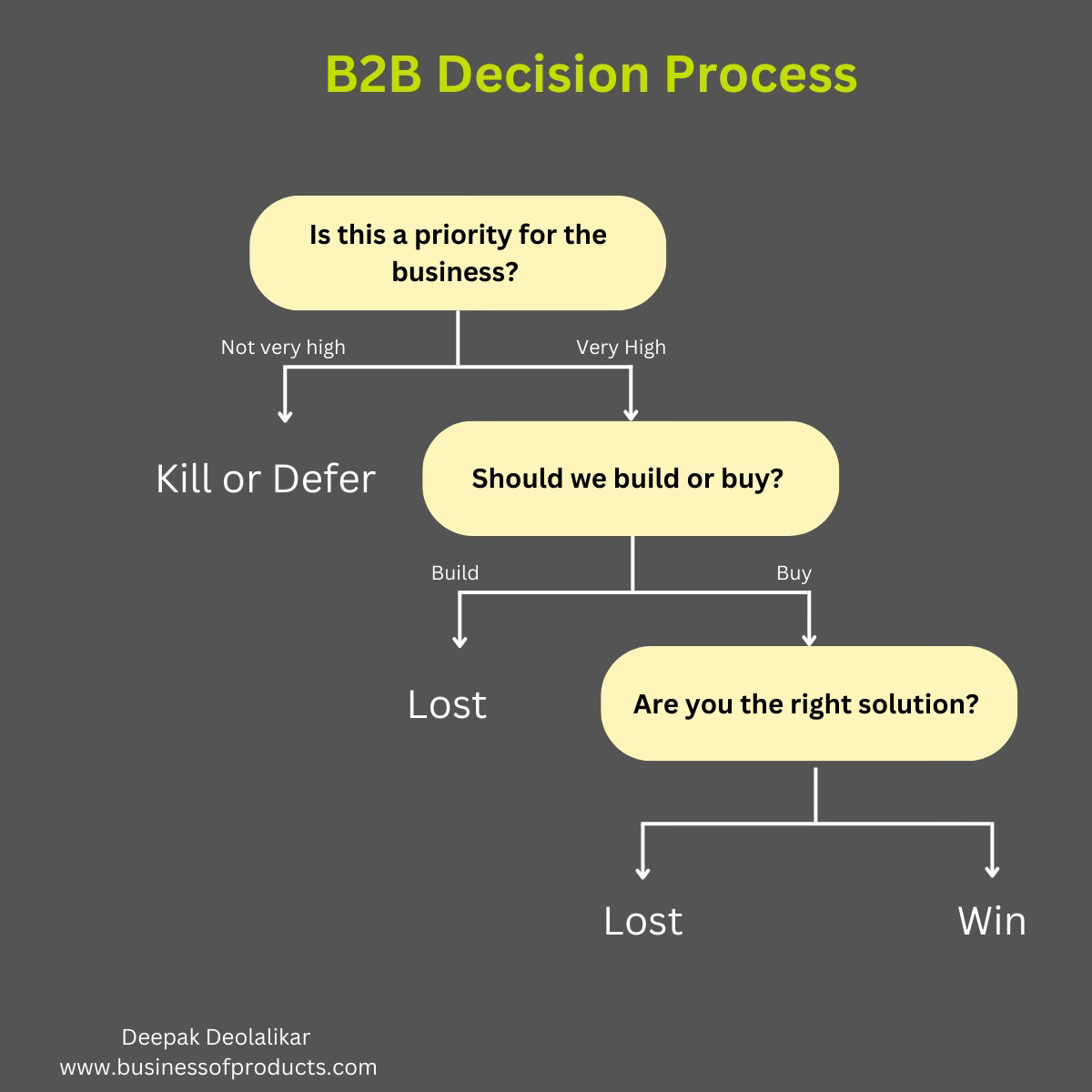

In my experience, there are three critical decision points every B2B buyer goes through:

1. Is this a priority?

2. Should we build in-house or buy?

3. Which vendor is the best fit?

Who owns the decisions?

In companies, purchase decisions happens in a committee. There is no one person responsible. At each decision, there is a different set of people involved. And this has a huge impact on your GTM, content, and sales outreach.

The decision to prioritize this problem (that you are solving) is owned by higher level executives. They own the resources and budgets. They are on the hook for selecting those projects that will maximize business results. Remember, the problem you are solving exists with many other problems that may be more urgent for the organization. In terms of marketing and outreach, this is the persona you have to address - the potential sponsor. You can help mid level executives who are pushing for this project with some supporting materials that they can use to convince their executives.

The next decision is to buy or build. Typically this is the R&D teams call. Of course, this does not apply to all types of products. No one in their mind will want to build a CRM or email product on their own. But there are many elements that can be built in-house. In my previous company, we built the single sign on infrastructure which could easily have been bought commercially. Same thing with notifications and messaging, in app tours, product metrics and telemetry etc. You have to show that the cost of building far outweighs the advantages of buying.

And finally, if you are the right vendor. Here, everyone in the buying committee will be involved. R&D to compare and contrast feature sets, legal to check compliances, procurement to deal with terms, and executives to confirm the viability of your company. This is especially important if your competitors are well established incumbents.

Today, we’ll focus on the first and arguably the most important question: Is this problem a high enough priority for them to act on?

If your prospect doesn’t see the problem as urgent, no amount of product pitching will work.

So how do you make them prioritize it?

(I’ll explain the other two in the next 2 weeks issues.)

Let’s dive in.

Decision Point #1 : Is this a Priority ?

Enterprises and B2B companies have 100s of problems across departments. And they are probably working on 4-5 of them at a time.

In many cases, they are not even aware they have a problem that needs to be solved or at least it has not been discussed. Budget constraints, internal politics, and competing initiatives mean that even a great solution can be deprioritized. For example, many customers may not be aware that an upcoming regulation is going to impact them. Which means they need to be educated about it first, and then heighten the urgency.

So the first decision point for a company is if this problem is a high enough priority to put resource into. At this stage, they are comparing the priority with other priorities in their company, which may have nothing to do with your own product.

I was once in a situation where we wanted to introduce our analytics tool into the hands of their business analyst. The problem was their data structures and data quality were poor. Analytics would not help them. So the first order of priority for them was to fix their house first.

When you target prospects in your chosen segment, then you have to select those for whom the problem your solution solves is a prioritized one.

How do you know that?

When you are in conversation with a prospect, this is the first qualifying question to ask. In more established companies, sales teams call this the BANT method. BANT - Budget, Authority, Need and Timeline. Essentially, this is a way of knowing how much has this customer priorities this problem.

If your prospects is not even aware of this problem, then probe them. Provide them with evidence. For example, let’s say you are selling an SEO solution that will help the prospect rank on search engines. Prospect might think they are OK, but you should show them your own evidence. You can show their current ranking, their competitors ranking, the keywords they are lacking. Tell them if they act now, they will see benefits of SEO 6 months later. That way you can educate them on the importance of solving the problem now.

How to Convince B2B Buyers That Your Startup’s Solution is a Priority

If you’re a B2B startup founder, you’ve probably faced this frustrating response from potential buyers:

“This looks great, but it’s not a priority right now.”

In enterprise sales, it’s not enough for buyers to believe your product is valuable—they need to see it as urgent. Budget constraints, internal politics, and competing initiatives mean that even a great solution can be deprioritized.

Chances are good that the prospect will not prioritize to solve this problem now. So, how do you push your product to the top of the priority list?

Here are some strategic moves that can help.

1. Tie Your Solution to Business-Critical Outcomes

B2B buyers make decisions based on revenue, cost efficiency, and risk. If your product doesn’t clearly improve one of these, it won’t feel urgent.

💡 Actionable Tip: Instead of pitching features, frame your solution around measurable business impact.

✅ Example: “Our automation tool reduces churn by 25%, adding $2M in retained revenue per year.”

When buyers see the financial upside, they’ll be more motivated to act. They can also compare the benefit of this project to the other projects they already have in flight.

Create marketing collateral around the business outcomes for a customer such as white paper, blog, social posts etc. Clearly outline the business impact

I recently installed solar panels which I was not in the market for. But when I saw the calculations and that I will break even in 3 years, I switched.

2. Leverage External Triggers & Industry Trends

Urgency often comes from outside pressures—market shifts, regulations, or competitive movements. Buyers act faster when they feel external forces are driving the need for change.

💡 Actionable Tip: Align your messaging with timely industry trends.

✅ Example: “New compliance regulations go into effect in Q3. Without automated tracking, you risk heavy penalties.”

If you can connect your product to a looming deadline or industry transformation, urgency skyrockets.

As of this writing, Gen AI is all the rage and every company is scrambling to implement AI in some shape or form. There is real FOMO. If you are an AI solution, you can use the industry shift to your advantage.

Write blog posts or guest articles and share your point of view on the trends. This showcases your authority and expertise.

3. Show How Their Competitors Are Moving First

No one wants to be left behind. If a competitor is already gaining an advantage, your buyer will feel pressure to act.

💡 Actionable Tip: Use benchmarking data or anonymized insights from similar companies.

✅ Example: “70% of your competitors have already implemented AI-driven contract automation. Where do you stand?”

FOMO (fear of missing out) is a powerful driver—use it strategically.

4. Make the Cost of Doing Nothing Clear

Many startups focus on the value of their product, but buyers also need to understand the cost of inaction. If the pain of staying the same is low, urgency will be low.

Now some customers maybe on the fence on the business case. In such cases, you can help them build their business case for internal executives. Provide them with as much expertise and information as possible. They will also trust you more and when they are convinced you have much higher shot at winning their business.

💡 Actionable Tip: Quantify the loss of delaying action.

✅ Example: “For every month you delay, you’re losing $50K in inefficiencies and manual work.”

When buyers see the hidden costs of waiting, they’ll move faster.

5. Create a “Now vs. Later” Comparison

Decision-makers don’t just need to know why they should act—they need to see the consequences of waiting.

💡 Actionable Tip: Paint a picture of how their situation deteriorates over time without your solution.

✅ Example:

Now: Implement a self-serve model and scale smoothly.

6 Months Later: Customer support costs skyrocket, and you’re scrambling for a fix.

Position your product as the proactive move, not the reactive fix.

6. Use Social Proof from High-Value Customers

Executives often look for validation from industry peers before making decisions. If a well-known company is already benefiting from your product, prospects will feel more urgency to act.

💡 Actionable Tip: Use case studies, testimonials, and customer logos strategically.

✅ Example: “See how [Industry Leader] reduced onboarding time by 40% with our platform.”

When prospects see other companies in their industry benefit, they want to know lest they get left behind. Buyers don’t want to be caught off guard from their executives if they find out what other companies are doing and yet you are not.

Final Thoughts

In B2B, buyers don’t act unless they see a clear and urgent reason to prioritize a solution. Your job as a founder isn’t just to prove that your product is great—it’s to make buyers feel like waiting is not an option.

You can turn “This looks great, but not right now” into “How fast can we get started?” by following one or more of these moves.

1. Tie Your Solution to Business-Critical Outcomes

2. Leverage External Triggers & Industry Trends

3. Show How Their Competitors Are Moving First

4. Make the Cost of Doing Nothing Clear

5. Create a “Now vs. Later” Comparison

6. Use Social Proof from High-Value Customers

Now granted, this is a hard sell. You do not have the authority to change priorities but you can try and influence. However, if you are convinced that the prospect will not prioritize then I suggest you move on and keep them in your future pipeline.

Next week we will tackle the question of Build vs Buy.