Hello PMs,

You read a lot about how you should become a good product manager. But what about how to be a good product team. In this article, I’ll focus on what it means to be a good product team. I will restrict to B2B since that is my domain, but I am sure they apply to B2C teams as well.

Product management is a complex function and requires a deep understanding of various disciplines. In a previous article, I had discussed the The 7 disciplines of B2B Product Management.

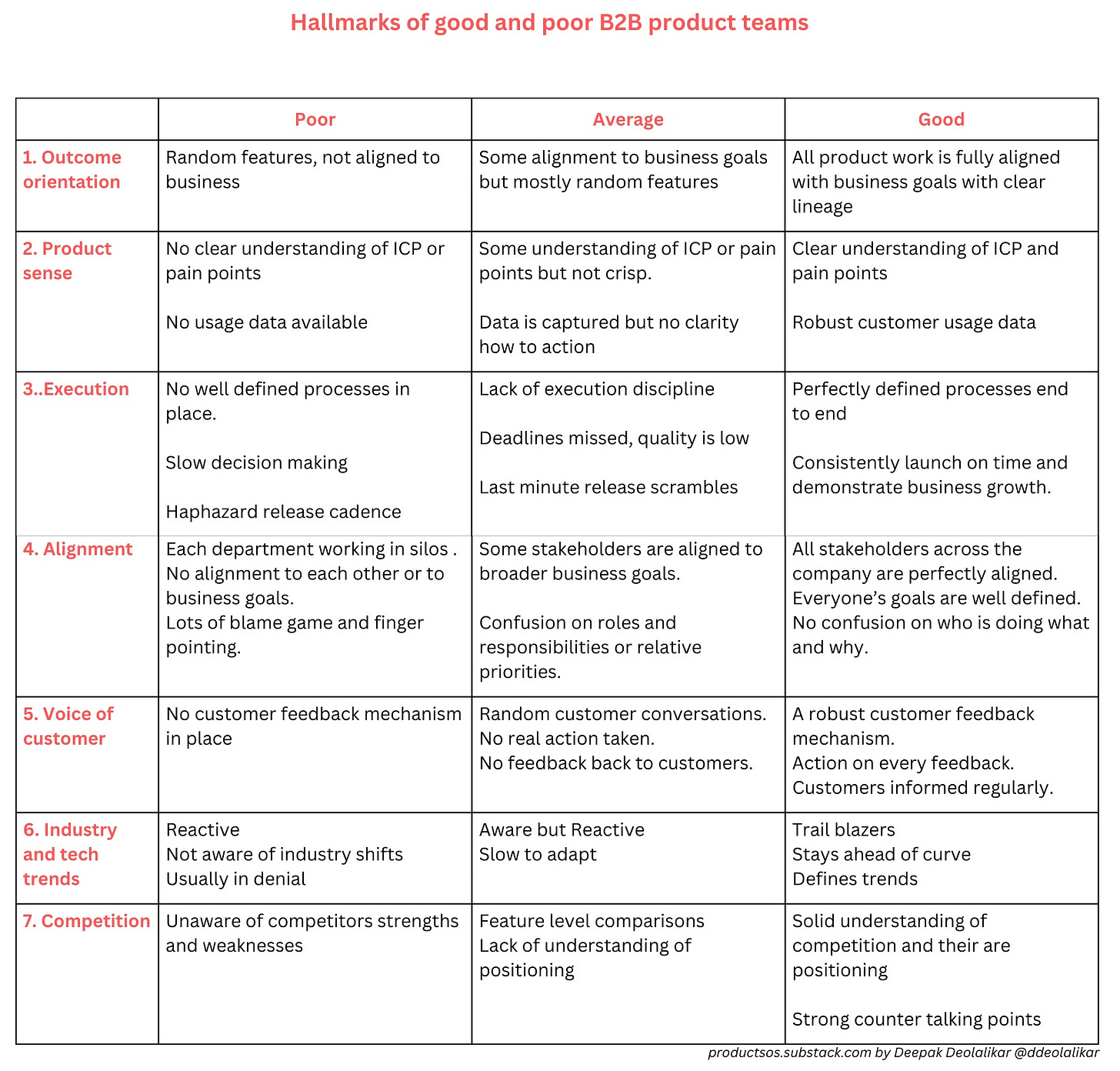

A good product team has a good handle on all aspects of these 7 disciplines.

These 7 disciplines are :

Outcome orientation

Product sense

Product execution

Stakeholder alignment

Voice of customer

Industry and technology trends

Competition

How do good and poor product teams do in each? Let’s go through each.

1. Outcome orientation

The primary objective of product orgs is to build products that drive business growth, plain and simple. This entails creating products that generate new revenue streams, facilitate upselling or cross-selling opportunities, and improve customer retention.

Additionally, optimizing product costs can contribute to enhancing overall profitability. While it is essential to prioritize customer satisfaction and ensure they can derive maximum value from your solution, these efforts must ultimately serve the end goal of driving business growth.

Good : In a high-performing product team, every aspect of their work is meticulously calibrated towards the accomplishment of overarching business objectives. This team boasts a comprehensive understanding of how each activity, no matter how granular, contributes directly to the company's strategic goals. Their relentless focus on aligning features, updates, and improvements with business outcomes ensures a coherent and impactful product development process. These teams are highly respected in their companies.

Average : An average product team demonstrates a mixed level of alignment with business goals. While some of their work does contribute to advancing the company's objectives, there's a notable proportion of efforts that appear disconnected or arbitrary. This team's performance reflects a moderate awareness of the need to tie their activities to larger business aspirations, but there's room for improvement in terms of consistently prioritizing impactful initiatives.

Poor : In poor product teams, the alignment between their work and business goals is conspicuously absent. Their endeavors appear disjointed, focusing on random features and updates without a discernible strategy to drive meaningful outcomes. This team struggles to tie their efforts to the company's success, resulting in limited impact on overall business performance.

2. Product sense

Having a strong product sense is crucial for effective B2B product management. Product sense encompasses a comprehensive understanding of customer pain points, the ability to design delightful experiences, and a data-driven approach to decision-making

Good : A good product team possesses a well-defined understanding of their Ideal Customer Profile (ICP), demonstrating an intimate awareness of customer pain points. They are adept at translating this knowledge into actionable product features that effectively address these pain points. With thorough market research and customer interaction, they refine their understanding over time, resulting in a product that resonates with users and consistently meets their needs.

Average : An average product team showcases a partial understanding of their ICP and customer pain points, although these insights are not yet finely honed. They may have identified certain pain points, but the clarity and depth of this knowledge are lacking. Their product decisions are somewhat guided by customer feedback, but there's room for improvement in terms of pinpointing precise pain points and translating them into impactful features.

Poor : This his team lacks a clear understanding of their Ideal Customer Profile and their pain points, leading to haphazard solution design. This often results in isolated silos of product development with no cohesive strategy, and their inability to track usage and adoption further contributes to their overall disconnect from customer needs.

A team with poor product sense has access to data but struggles to extract meaningful insights from it. They fail to effectively interpret customer feedback or usage data, resulting in a lack of actionable ideas for enhancing adoption or generating new product concepts.

Execution

Strategy and planning are essential, but they must be accompanied by impeccable execution. Effective execution is the bridge that connects strategy to tangible results, enabling the delivery of products that truly make an impact on customers and the business as a whole.

Good : A top-tier product team boasts meticulously defined processes, a well-structured framework, and clearly defined roles from the initial discovery phase through product launch and eventual adoption. This streamlined approach empowers them to consistently meet deadlines, and their proficiency reflects in sustained business growth. Their adept coordination and smooth execution of each phase ensure that products are launched on time.

Average : An average product team has the essential components in place, including team members and roles, but they struggle with consistent execution discipline. Their processes might lack refinement, leading to occasional delays or suboptimal outcomes. While they may meet some deadlines, there's room for improvement in terms of adhering to a more structured and efficient approach, potentially hampering the pace of business growth.

Poor : A poor product team grapples with a lack of organization, frequently missing deadlines and compromising on the quality of their deliverables. Their releases are characterized by last-minute rushes and unexpected hurdles. With no well-defined processes to guide their efforts, they often encounter roadblocks that hinder progress. Decision-making is sluggish, and the absence of clear guidelines leaves them uncertain about the feasibility of releases, resulting in a strained relationship with both timelines and business growth objectives.

4. Stakeholder alignment

Successful B2B product management requires close alignment with various stakeholders, including sales, marketing, engineering, and executive leadership. Establishing clear communication channels and fostering cross-functional collaboration is vital to ensure that everyone is working towards the same goals.

Good : In good teams, all stakeholders across the organization are seamlessly synchronized with the overarching business goals and the product strategy. Each stakeholders objectives are meticulously outlined, leaving no room for ambiguity regarding roles and responsibilities. This alignment cultivates a collaborative environment where everyone understands their contributions, fostering an efficient and effective pursuit of common objectives. Everyone in the company is aware of what is being release and when by the product team.

Average : In average teams, certain stakeholders display alignment with the broader business objectives and product strategy. However, a degree of confusion might persist regarding specific roles, responsibilities, or the relative prioritization of tasks. While some coordination exists, there is room for improvement in terms of achieving a more cohesive and well-coordinated approach.

Poor : In poor teams, different departments operate in isolation, pursuing their own initiatives without regard for broader business objectives. There's a glaring lack of alignment between teams, resulting in a fragmented landscape where collaboration is scarce. Finger-pointing and a blame-oriented culture prevail due to the absence of shared goals and strategy. This dysfunction stifles progress and diminishes the organization's ability to work harmoniously towards common objectives.

5. Voice of customer

Voice of customer is a fancy term to say that we listen and gather feedback from customers in a structured way, and influence our product strategy. Customer feedback provides insights into their pain points, preferences, and expectations. These inputs inform your product roadmap, prioritize features, and continuously improve the customer experience.

Good : These teams have established and robust customer feedback mechanism that aggregates input from various sources, including customer support, success teams, and direct feedback channels. Each piece of feedback is systematically discussed, analyzed, and translated into actionable items. Customers are kept informed about the progress made based on their input, fostering a sense of engagement and trust between the product team and its user base.

Average : In an average team, there is encouragement for customer feedback but they are sporadic and random. The actions taken in response to this feedback are inconsistent or even nonexistent. Customers might not receive updates on how their input is influencing product development, leading to a potential gap in communication and a missed opportunity for enhancing the customer experience.

Poor : In poor teams, there is a lack of structured mechanisms for gathering customer feedback. While some ad hoc conversations might occur between product managers and customers, there's little to no follow-up or meaningful action taken. This disregard for customer insights undermines the product's ability to address real user needs and preferences, resulting in potential misalignment with market demands.

Industry and tech trends

Being aware of industry trends and emerging technologies is essential for B2B product managers. Industry and technology constantly evolve. As a PM, you have to keep up with the trends or your product will either stagnate or perish. Worse, competition can get take advantage of trends and move ahead.

Good : A high-performing team excels in not only staying abreast of current industry and technological trends but also in being at the forefront of setting new trends. This team actively seeks out emerging shifts, anticipates changes, and often leads the way in adopting innovative technologies and methodologies. Their proactive approach positions them as trailblazers, ensuring they remain ahead of the curve and aligned with the evolving landscape.

Average : An average team demonstrates a reasonable understanding of industry and technical trends but tends to be more reactive than proactive. While they can identify emerging changes, they might not always act swiftly to adapt. Their ability to adopt new technologies and methodologies is moderate, and their responsiveness to industry shifts may vary, potentially leading to delays in implementation.

Poor : A team struggling with industry and tech trends is frequently caught in a reactive mode, struggling to keep up with rapid technological changes. They may lack awareness of significant shifts within the industry or exhibit a tendency to deny the importance of these shifts. This myopic perspective limits their ability to adapt and innovate, and they risk falling behind competitors who are more attuned to the evolving landscape.

7. Competition

In a mature B2B market, competition is fierce. By understanding the strengths and weaknesses of your competitors, you can make informed decisions about positioning, pricing, and feature development, giving your product a competitive edge.

Good : A good product team possesses a comprehensive grasp of their competitors' landscape, understanding not only who the key players are but also how they are positioning themselves in the market. This team goes beyond mere feature comparisons and develops strategic talking points to counter each competitor effectively. Their ability to analyze and respond to the strengths and weaknesses of their rivals gives them a distinct advantage in positioning their own product.

Average : An average product team possesses knowledge of their competitors' feature sets, but they often struggle to gain a competitive edge in deals due to a lack of deeper insights into their competitors' positioning strategies. While they can identify surface-level differences, they may not fully understand the nuanced ways their competitors are presenting themselves. This can lead to missed opportunities to effectively differentiate their own product.

Poor : A team with a poor grasp of competition lacks awareness of how competitors are positioning themselves and what their strengths and weaknesses are. This deficiency in competitive intelligence leaves them ill-equipped to respond effectively in the market. They may miss opportunities to differentiate their product, and their lack of understanding can potentially result in losing deals to competitors who have a stronger market presence and clearer messaging. Most of the time these times are just copying features from their competition in order to stay relevant.

Conclusion

Now you can use this matrix to assess where your product team falls in the spectrum, what are the gaps and what you should do next to fill these gaps.

Of course, not everything is important. Some of these like outcome orientation, product sense, execution are the bare minimum that all teams have to be really good at.

Depending on your context, the other disciplines may be important.

For example, if you are in a competitive market, then having a good handle on competition is critical. Not if you are an early stage company. If you have a lot of customers, then managing customer feedback is important. Not in early stages. If you are in a regulated industry, then keep a tab on industry shifts is critical.

Would love your feedback on this framework?

What other dimensions make a good B2B product team.

Reply back to me on this email or DM on X or LinkedIn.

PS- I’ll be on vacation for the next two weeks so likely won’t have a newsletter. But I do have a several posts planned on LinkedIn and X. So do follow me there.

I’ll write in a couple of weeks from now.

Ciao.

I have some bandwidth to coach product teams and individuals. Interested?

Schedule an introductory 30 min call.